IDEXX LABORATORIES INC /DE (IDXX)·Q4 2025 Earnings Summary

IDEXX Q4 2025: Revenue Beats, EPS In-Line as inVue Dx Hits Record Placements

February 2, 2026 · by Fintool AI Agent

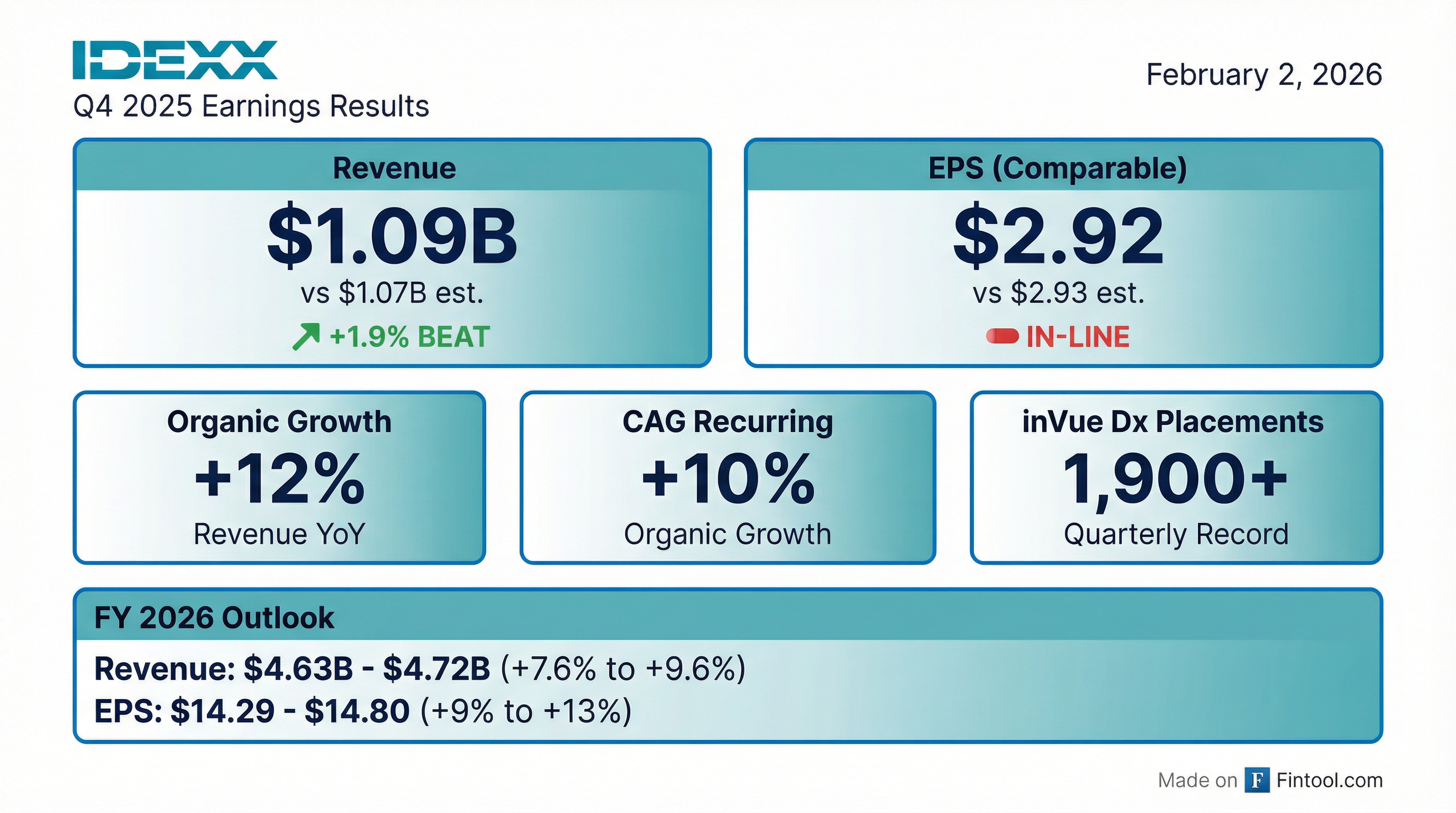

IDEXX Laboratories delivered a strong finish to 2025, reporting Q4 revenue of $1.09B (up 14% YoY) that beat consensus by 1.9%, while comparable EPS of $2.92 came in essentially flat to the $2.93 estimate. The slight EPS miss—IDEXX's first in 9 quarters—combined with 2026 guidance that met but didn't exceed expectations sent shares lower in early trading.

The quarter was highlighted by record instrument placements, with over 1,900 IDEXX inVue Dx analyzers placed—a new quarterly record that drove CAG Diagnostics capital instrument revenue up 76% YoY.

Did IDEXX Beat Earnings?

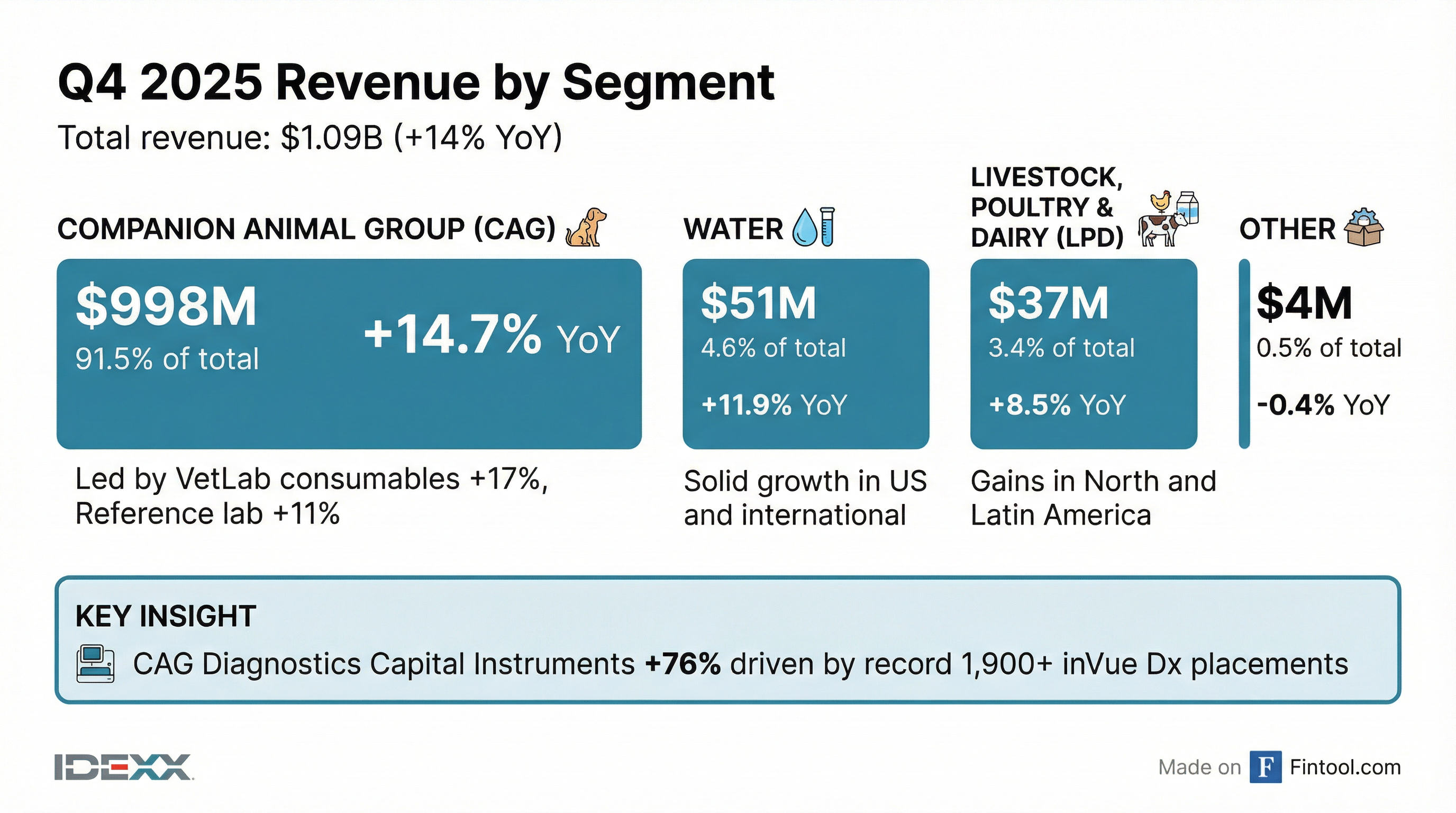

Revenue beat was driven by 14.7% CAG segment growth, while the slight EPS shortfall reflects higher-than-expected operating expense growth (+11% YoY) from commercial investments and R&D spending.

Earnings Beat Streak Ends

IDEXX had beaten EPS estimates for 8 consecutive quarters before this report:

How Did the Stock React?

Shares traded lower following the report, with the stock dipping from its prior close of $676.71. The market reaction reflects:

- First EPS miss in 9 quarters — even a slight shortfall breaks the beat streak

- 2026 guidance met but didn't exceed — Street was looking for upside

- Operating expense growth (+11%) — higher than revenue growth trajectory

Despite the post-earnings dip, IDXX remains up significantly from its 52-week low of $356.14, trading near the upper end of its range with a 52-week high of $769.98.

What Did Management Say?

"In many respects, 2025 was a defining year for our company. We successfully scaled multiple transformative innovations, expanded our commercial presence in key international regions, and continued to demonstrate the resilience and durability of the IDEXX business model."

— Jay Mazelsky, President and CEO

"Evidence shows that we can detect lymphoma signal up to eight months prior to clinical manifestation of disease. This means crucial months of earlier detection and treatment potential."

— Jay Mazelsky, on Cancer Dx

Management emphasized that 2025 marked a transition year with major product launches now driving recurring revenue growth. The inVue Dx platform and Cancer Dx test represent "an important new phase of IDEXX's growth, expanding the role of diagnostics in earlier disease detection." The company completed commercial footprint expansions in Germany, UK, Ireland, and Australia in Q4, with new team members now fully onboarded and active.

What Changed From Last Quarter?

Key acceleration: Organic revenue growth improved from 9% in Q3 to 12% in Q4, driven by stronger international performance (+12% CAG Diagnostics recurring revenue organically internationally vs +9% in U.S.).

Customer retention: Remains in the "high 90s" for global CAG Diagnostics business, underscoring the stickiness of IDEXX solutions.

Segment Performance

Companion Animal Group (CAG) — 91.5% of Revenue

The 76% surge in CAG Diagnostics capital instruments reflects the record 1,900+ inVue Dx placements plus nearly 1,400 new and competitive Catalyst placements. This installed base expansion drives future consumables growth.

inVue Dx Milestones:

- FNA launch: In December, IDEXX reached an important milestone with the controlled launch of fine needle aspirate (FNA) capability on inVue Dx for mast cell tumor detection

- CEO Mazelsky described FNA as "a platform of its own" that automates key steps and applies AI-powered analysis, allowing results within minutes while the patient is still in the clinic

- Full year placements: ~6,400 inVue Dx instruments in 2025, contributing over $75M in instrument revenue (~200 bps of company growth)

Water — 4.6% of Revenue

Revenue of $50.5M grew 12% reported and 10% organic, with solid growth in both U.S. and international markets.

Livestock, Poultry & Dairy (LPD) — 3.4% of Revenue

Revenue of $37.5M grew 8% reported and 4% organic, led by gains in North and Latin America across major product categories.

Margins and Profitability

Operating margin expansion was driven by strong volume gains, reference laboratory productivity initiatives, and net price realization that more than offset inflationary impacts.

Full Year 2025: Operating margin expanded 270 bps to 31.6%, though ~180 bps of this was due to lapping a discrete litigation expense accrual from 2024. On a comparable basis, operating margin expanded 90 bps.

What Did Management Guide?

2026 Outlook

Other 2026 assumptions:

- Net interest expense: ~$34M

- Effective tax rate: ~21.3%

- Share repurchase benefit: 1-2% reduction in average shares

- Capital expenditures: ~$180M

- Free cash flow: 85-95% of net income

Guidance vs Prior Quarter

2026 guidance represents a deceleration from FY 2025's 10% organic revenue growth to 7-9%, which may be contributing to the muted stock reaction. The Street was looking for continued double-digit organic growth given the inVue Dx momentum.

Capital Allocation

Share Repurchases: IDEXX repurchased 2,427 shares for $1.23B in FY 2025 at an average price of $505.74 per share. In Q4 alone, the company bought back 356k shares for $242M at an average price of $680.28.

Free Cash Flow: FY 2025 free cash flow of $1.06B represented 100% conversion of net income, up from $808M in FY 2024.

Balance Sheet: Total debt of $848M against cash of $180M for net debt of $668M. The company maintains strong liquidity with a credit facility and investment-grade profile.

Key Risks and Concerns

-

Guidance deceleration — 7-9% organic growth guide for 2026 vs 10% achieved in 2025 suggests slowing momentum

-

Rapid assay decline — Third consecutive quarter of negative growth (-2% in Q4) as Catalyst Pancreatic Lipase Test shifts testing volume across modalities

-

Operating expense growth — 11% opex growth outpaced 12% organic revenue growth in Q4, pressuring margin trajectory

-

Currency headwinds — 2026 guidance assumes ~30 bps operating margin headwind from FX and ~$0.22 EPS impact

-

Tariff and trade policy uncertainty — Management flagged changes in U.S. and other countries' tariff policies as a risk factor

Forward Catalysts

- Cancer Dx mast cell tumor launch — Expected mid-year 2026 in North America; will detect ~1/3 of most common cancer types during routine wellness visits

- Cancer Dx international rollout — Q1 2026 international expansion for canine lymphoma test

- FNA scale-up — Controlled launch expands through 2026; management views FNA as "a platform of its own"

- Corporate practice penetration — inVue Dx corporate sell-in underway with longer cycle; could accelerate 5,500 placement target

- Pandemic pet aging — Two consecutive quarters of improving visits for 5+ year old pets; structural tailwind for diagnostics

- Q1 2026 guidance — 11.5%-13.5% reported revenue growth, 9%-11% organic; includes ~1-1.5% CAG instrument revenue benefit from inVue momentum

Q&A Highlights

Clinical Visit Trends

Management provided important context on the divergence between wellness and non-wellness visits:

- Non-wellness visits represent ~60% of total visits but 70-75% of diagnostics revenue

- U.S. same-store clinical visits declined 1.7% in Q4 and 1.9% for full year 2025

- Wellness visits more pressured than sick patient visits (wellness -3.6% in Q4)

- Green shoots emerging: Two consecutive quarters of improving visits for pets 5+ years old, reflecting pandemic adoption boom aging

"The pandemic adoption boom... these pets aging, will likely continue going forward." — Jay Mazelsky

Cancer Dx Economics

Management quantified the Cancer Dx opportunity:

- Addressable market: $1.1B over time for the Cancer Dx panel expansion

- Pricing: ~$60 standalone, ~$15 when included in a broader diagnostic panel

- Lymphoma monitoring: ~130,000 tests/year addressable opportunity in North America alone

- Screening adoption: Over half of lymphoma tests submitted are now for screening vs aid in diagnosis

- Competitive submissions: 18% of Cancer Dx tests come from customers who don't use IDEXX as their primary reference lab

inVue Dx and Platform Economics

- Consumables per instrument: $3,500-$5,500 per inVue Dx, including FNA once launched

- Corporate adoption: Now placing inVue Dx into corporate practices; longer sell-in cycle but well underway

- 2026 target: 5,500 inVue Dx placements planned

Catalyst Installed Base

- Global install base: Nearly 78,000 Catalyst analyzers worldwide

- Q4 placements: 1,350+ new/competitive Catalyst placements globally, 360+ in North America

- Pancreatic Lipase adoption: Over 50% of North American Catalyst users adopted the test in first 12 months

Software and Vello

- Vello users: Grew 40% QoQ and nearly tripled YoY

- Cloud PIMS: Double-digit installed base growth for ezyVet and Neo platforms

- Impact: Clinics using Vello report improved communication, increased visit frequency, and better compliance vs basic engagement tools

Pricing Environment

- 2026 net price: ~4% globally, ~3.5% in U.S. (modestly lower than 2025)

- Vet practice pricing: Corporate practices showing some moderation but still above CPI; management noted corporate practices are focused on driving demand and patient traffic

International vs U.S. Growth

- Management expects international CAG Diagnostics recurring revenue to grow faster than U.S. over time

- International markets are earlier in diagnostics adoption and more weighted to sick patient testing

- Recent investments in Germany, UK, Ireland, and Australia position IDEXX for sustained double-digit international growth

Full Year 2025 Summary

The Bottom Line

IDEXX delivered a solid Q4 with revenue beating expectations and strong instrument placement momentum, but the slight EPS miss ended a 9-quarter beat streak and 2026 guidance suggested moderating growth ahead. The inVue Dx platform is clearly gaining traction (1,900+ quarterly placements vs initial expectations), but investors wanted more upside to the outlook. With the stock trading at ~46x forward earnings, execution on the 8-10% CAG recurring growth guide will be critical to maintaining the premium multiple.

Earnings call held February 2, 2026. Replay available.

Key Call Participants: Jay Mazelsky (President & CEO), Andrew Emerson (CFO), John Ravis (VP, Investor Relations)

Related: